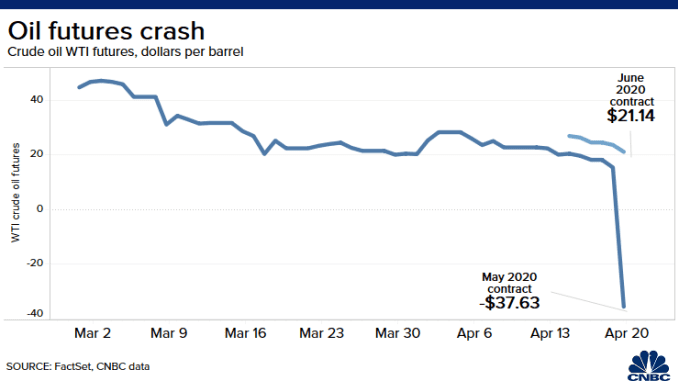

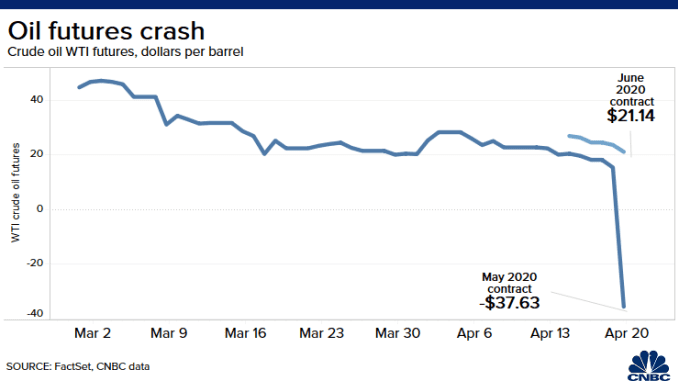

West Texas Intermediate crude futures for May delivery pared losses to trade in positive territory on Tuesday, one day after plunging below zero for the first time in history. The contract expires today, which means that thin trading volume has contributed to the wild price action.

The massive selling gripping the oil market is now spreading to more futures contracts, worrying investors about the deep economic damage being done by the coronavirus shutdowns.

The contract for June delivery, which is the more actively traded and therefore a better indication of how Wall Street views the price of oil, slipped 24% to $15.56 per barrel. Earlier in the session it had dipped below $15. The contract for July delivery fell roughly 11% to $23.42.

The May contract last traded at $1.30 per barrel after previously trading in negative territory, which means sellers would effectively pay buyers to take the oil off their hands. On Monday it fell below zero for the first time in history. However, as contracts approach expiration, trading volume is typically thin.

The front part of the oil futures ‘curve,’ which is the May contract that expires today, was hit the hardest since it applies to fuel that’s set to be delivered while most of the country remains on lockdown thanks to the coronavirus. The only buyers of oil futures for that contract are entities that want to physically take the delivery like a refinery or an airline. But demand has dropped and storage tanks are filled, so they don’t need it.

Futures contracts trade by month with expiration dates. Toward the end of their expiration, speculators usually trade out of the contract and then buyers who will accept physical delivery of the commodity remain.

Meanwhile, in another bearish sign, international benchmark Brent crude traded 15.5% lower at $21.60 per barrel. Earlier in the session Brent fell to $18.10, its lowest level since Dec. 2001, before paring some of those losses.

“Oil futures continue to defy gravity,” Louise Dickson, Rystad Energy’s oil markets analyst, told CNBC in an email. “This moment is of course historical and could not better illustrate the price-utopia that the market has been in since March, when the full scale of the oversupply problem started to become evident but the market remained oblivious,” she added.

And as storage continues to fill, some are warning that prices could trade at extremely depressed levels for the foreseeable future.

“We expect extremely weak fundamentals to persist for at least the next month,” Deutsche Bank analyst Michael Hsueh wrote in a note to clients Monday. “Continued pressure on infrastructure may result in negative pricing at some point again before the end of May, on the current trajectory,” he added.

The coronavirus pandemic has led to unprecedented demand loss. The International Energy Agency warned in its closely-watched monthly oil report that demand in April could be 29 million barrels per day lower than a year ago, hitting a level last seen in 1995. And with places to store the crude quickly filling, some argue that prices could stay lower for longer.

“Even as OPEC++ oil production cuts are set to kick in May 1, and supply and inventories should tighten significantly in 2H′20, the next 4-6 weeks are seeing severe storage distress, likely to drive wild price realizations and unusual disconnects, including supercontango and negative prices,” Citi analysts led by Eric Lee wrote in a note to clients Monday.

The spread between the May and June contracts — known as the front month and second month — is now the widest in history, which Bernadette Johnson, vice president of strategic analytics at Enverus, described as “insane.”

“That’s a very strong signal that there are bottlenecks in the physical market and people are having a hard time placing barrels,” she said.

On Tuesday President Donald Trump, who was heavily involved in brokering the historic production cut between OPEC and its allies, weighed in on falling oil prices. In a tweet he said that he had “instructed the Secretary of Energy and Secretary of the Treasury to formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!”

- CNBC’s Michael Bloom contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

And as storage continues to fill, some are warning that prices could trade at extremely depressed levels for the foreseeable future.“We expect extremely weak fundamentals to persist for at least the next month,” Deutsche Bank analyst Michael Hsueh wrote in a note to clients Monday. “Continued pressure on infrastructure may result in negative pricing at some point again before the end of May, on the current trajectory,” he added.The coronavirus pandemic has led to unprecedented demand loss. The International Energy Agency warned in its closely-watched monthly oil report that demand in April could be 29 million barrels per day lower than a year ago, hitting a level last seen in 1995. And with places to store the crude quickly filling, some argue that prices could stay lower for longer.“Even as OPEC++ oil production cuts are set to kick in May 1, and supply and inventories should tighten significantly in 2H′20, the next 4-6 weeks are seeing severe storage distress, likely to drive wild price realizations and unusual disconnects, including supercontango and negative prices,” Citi analysts led by Eric Lee wrote in a note to clients Monday.The spread between the May and June contracts — known as the front month and second month — is now the widest in history, which Bernadette Johnson, vice president of strategic analytics at Enverus, described as “insane.”“That’s a very strong signal that there are bottlenecks in the physical market and people are having a hard time placing barrels,” she said.On Tuesday President Donald Trump, who was heavily involved in brokering the historic production cut between OPEC and its allies, weighed in on falling oil prices. In a tweet he said that he had “instructed the Secretary of Energy and Secretary of the Treasury to formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!”

And as storage continues to fill, some are warning that prices could trade at extremely depressed levels for the foreseeable future.“We expect extremely weak fundamentals to persist for at least the next month,” Deutsche Bank analyst Michael Hsueh wrote in a note to clients Monday. “Continued pressure on infrastructure may result in negative pricing at some point again before the end of May, on the current trajectory,” he added.The coronavirus pandemic has led to unprecedented demand loss. The International Energy Agency warned in its closely-watched monthly oil report that demand in April could be 29 million barrels per day lower than a year ago, hitting a level last seen in 1995. And with places to store the crude quickly filling, some argue that prices could stay lower for longer.“Even as OPEC++ oil production cuts are set to kick in May 1, and supply and inventories should tighten significantly in 2H′20, the next 4-6 weeks are seeing severe storage distress, likely to drive wild price realizations and unusual disconnects, including supercontango and negative prices,” Citi analysts led by Eric Lee wrote in a note to clients Monday.The spread between the May and June contracts — known as the front month and second month — is now the widest in history, which Bernadette Johnson, vice president of strategic analytics at Enverus, described as “insane.”“That’s a very strong signal that there are bottlenecks in the physical market and people are having a hard time placing barrels,” she said.On Tuesday President Donald Trump, who was heavily involved in brokering the historic production cut between OPEC and its allies, weighed in on falling oil prices. In a tweet he said that he had “instructed the Secretary of Energy and Secretary of the Treasury to formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!”

Comments

Post a Comment